Current State of Malaysia's Hotel Linen Industry

part I. Market Size and Growth Trends

In recent years, the robust growth of Malaysia's hotel, property, and catering industries has

significantly driven the expansion of the linen market. Taking the hotel linen segment as an

example, data from Statista shows that the revenue of Malaysia's bedding market is projected

to reach $224.7 million in 2025, with an expected annual growth rate of 4.09% from 2025 to

2029.

With the continued boom in Malaysia's tourism industry, popular destinations such as Melaka,

Penang, Kuala Lumpur, and Kota Kinabalu have seen a continuous increase in accommodation

facilities like hotels and homestays, leading to rising demand for high-quality hotel linens. In

Kuala Lumpur alone, several mid-to-high-end hotels were added in the first half of 2024, not

to mention projects still under construction.

These developments have directly driven demand for various linen products, such as bedsheets,

duvet covers, and towels, pushing the market scale to new heights. From a long-termperspective, as living standards improve, the demand for higher quality and greater quantity

of linens is also increasing, further propelling the linen market forward.

I. Linen Products: Categorized by Application Scenarios

Linen products can be divided into several major types based on their application scenarios:

Hotel/Accommodation Linen: The most representative category. Includes:

Bedding: Sheets, duvet covers, pillowcases, pillows, duvets, bed skirts, bed runners, etc.

Bath Linen: Towels, bath towels, bathrobes, bath mats, etc.

Guest Room Linen: Curtains, sofa covers, tablecloths, napkins, etc.

Food & Beverage (F&B) Linen: Suitable for restaurants, hotel F&B outlets, etc. Includes items like tablecloths, napkins, chair covers, billiard table cloths, coasters, etc., emphasizing aesthetics and durability.

Medical/Healthcare Linen: For use in hospitals and clinics. Includes items like patient gowns, sheets, duvet covers, pillowcases, surgical drapes, nurses' uniforms, isolation gowns, sterilization wraps, etc. Emphasizes hygiene standards and antibacterial properties, with some items requiring compliance with medical sterilization requirements.

Linen for Other Scenarios: Includes towels and bed covers for beauty salons; nursing sheets and duvet covers for elderly care homes; seat covers, blankets, and pillowcases for first class/economy class on airlines/cruise ships, etc. These need to meet the usage intensity and functional requirements (e.g., flame retardancy, easy cleaning) of specific scenarios.

II. Linen Industry Chain Components

Upstream: Raw Material Supply

Includes fabric raw materials such as cotton, chemical fibers (polyester, nylon, etc.), wool, down/feathers, as well as textile auxiliaries (dyes, detergents, etc.).Midstream: Production and Processing

Encompasses fabric weaving (by weaving mills), finished product sewing (e.g., by bedding manufacturers, towel factories), printing/dyeing, and other processes. Some companies offer customization services (e.g., embroidered labels, logo printing).Downstream: Sales and Services

Includes wholesale supply to business (B2B) clients such as hotels, hospitals, and catering enterprises, as well as value-added services like linen rental, laundry and disinfection (by professional cleaning companies), recycling, and disposal.

PartII. Opportunities for Chinese Companies Expanding into Malaysia

1. Product Price-Performance Ratio Advantage

As a global leader in textile production and export, China possesses a robust industrial foundation for manufacturing hotel linen. The country is home to numerous mature textile enterprises with massive industrial scale, covering various stages from towel manufacturing and fabric weaving to finished product production. This structure enables large-scale production capacity, effectively reducing costs. Compared to some local Malaysian companies, Chinese-produced linen offers more competitive pricing while maintaining quality assurance. This allows Chinese companies entering the Malaysian market to attract cost-conscious customers with high value-for-money products. This is particularly effective in segments like the mid-to-low-end hotel market, where price advantages can be leveraged to quickly gain a foothold and capture market share.

PartIII. Product Innovation Capability

Chinese textile enterprises are increasingly investing in technological R&D and product innovation, allowing them to keep pace with international trends and develop innovative linen products that meet the demands of the Malaysian market. For instance, tailored to Malaysia's hot and humid climate, they can research and develop new fabric linens with breathable and quick-drying features, providing hotel guests with a more comfortable experience. Against the backdrop of prevailing environmental awareness, they can leverage advanced domestic technology to launch linen series made from sustainable materials like recycled fibers and organic cotton. Through continuous product innovation, Chinese companies can better fulfill the Malaysian hotel industry's need for differentiated, high-quality linen. This enables them to stand out in the competitive market, build a unique brand image, and win favor from more high-end hotel clients.

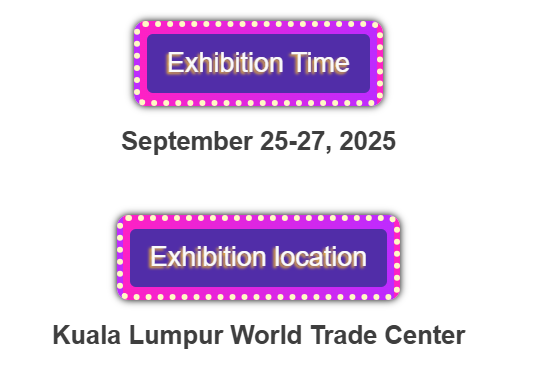

Part III. Platform of International-Level Exhibitions

The MCTE (Malaysia Commodity & Trade Expo), as an international-level professional exhibition and trade platform, boasts official endorsement and guidance from esteemed institutions such as the Malaysia External Trade Development Corporation (MATRADE), Malaysia Convention & Exhibition Bureau (MyCEB), Tourism Malaysia, the China Association for Inspection and Quarantine, and the Economic & Trade Office of Guangdong Province in Southeast Asia (Kuala Lumpur).

It also receives strong support from numerous authoritative industry organizations, including the American Hotel & Lodging Association (though noted as U.S. Hotel Real Estate General Chamber), the California Lodging & Hotel Association, the Los Angeles Hospitality Association (though noted as U.S. Los Angeles Hotel Supplies Association), the Malaysia Business Hotel Association, the Malaysian Furniture Council, the Malaysian Furniture Entrepreneur Association, the Johor Chinese Building Contractors Association, the Malaysia Food & Beverage Executives Association, and the Malaysia Restaurant Association.

The exhibition deeply integrates the hotel, property, and catering sectors, bringing together industry forces from multiple countries and regions including the United States, Switzerland, Malaysia, Thailand, Singapore, Egypt, Japan, South Korea, and Mainland China, Hong Kong, and Taiwan. It attracts leading enterprises such as China Construction Yangtze (Malaysia), Hilton, Parkson Group, Sunway Group, Genting Group, Mercury Group, IKEA, Harvey Norman, Ceria Hotel, and GD Property.

MCTE provides a direct platform for expanding enterprises to showcase their products to global buyers, facilitates precise connection of cooperative resources, shares cutting-edge industry trends, and efficiently helps them explore the Southeast Asian and global markets.

The 7th MCTE Malaysia Hardware, Home Improvement and Building Materials Expo

MCTE ASEAN Hotel Supplies and Landscape Art Expo

The 4th MCTE Malaysia Food, Pre-packaged Cuisine, and Catering Expo

The 3rd MCTE ASEAN Ceramics, Gifts, and Lifestyle Expo

MCTE Honor Wall

MCTE Collaborative Media

MCTE part partners

CN

CN ENG

ENG